By Melodie Michel, Editor, Chief Reporter, CSO Futures

The article was originally published by CSO Futures

It’s no coincidence that 2023 – the hottest year on record – was the year adaptation and resilience climbed up further than ever on the global climate agenda. But what does climate resilience mean at company level, and how can Chief Sustainability Officers integrate it into their work?

It is now becoming clear that our efforts to curb climate change have been too slow so far: greenhouse gas emissions reached a record 40 billion tonnes last year, and although experts are hopeful that mitigation work will accelerate exponentially in the coming years, the effects of global temperature increases are here and clear.

In 2022, severe storms cost insurers US$60 billion and 97% of companies were already feeling the negative impacts of climate change. In this year’s WEF Global Risks Report, extreme weather events were ranked as the number one risk likely to cause a global crisis in the coming year.

Climate adaptation and resilience is growing on the climate agenda: the final global stocktake agreement signed by countries at COP28 called for “urgent, incremental, transformational and country-driven adaptation action based on different national circumstances”, while in January 2024, Davos attendees were also urged to move towards regenerative business models to adapt to climate change.

Companies lagging behind on climate resilience and adaptation

But companies still are not doing enough: the latest progress report released by the Task Force on Climate-Related Financial Disclosures revealed that almost none (11%) assess the resilience of their strategies in various climate scenarios.

One of the problems may be around companies’ understanding of resilience: “Currently, varying levels of awareness and diverse approaches to climate risk management and resilience planning within businesses limit essential action for and investments in climate resilience. This absence of common understanding, shared playbooks and metrics represents a major obstacle to the ability of CSOs to unite efforts across sectors and take decisive and aligned action towards climate resilience,” says Shazre Quamber-Hill, Director of Network Strategy and Impact at Resilience First, which held a roundtable discussion on mobilising private finance for adaptation at COP28.

In contrast, mitigation has attracted most of the attention, perhaps because it is much easier to understand: “You can sum up mitigation in two words: net zero,” notes Nathanial Matthews, CEO of the Global Resilience Partnership on a call with CSO Futures. “Resilience is about engaging in a system and thinking about the system’s perspective. And that does scare people, both from a measurement and evidence perspective.”

As a result, private investment in adaptation and resilience is sorely lacking. While 32% (US$15.5 billion) of private finance mobilised through partnerships with multilateral and development banks between 2018 and 2020 targeted climate-related issues, only 4% (US$1.8 billion) was earmarked exclusively for adaptation.

Climate resilience vs mitigation in the CSO budget

For Matthews, Chief Sustainability Officers should spend no less than half of their budget on making their companies more resilient to the impacts of climate change. “I think it has to be 50/50. Because again, if you’re not investing in adaptation and resilience, you’ll completely derail your mitigation efforts, I think that is clearer than ever before now,” he explains.

That means for every dollar spent reducing emissions, another should go towards protecting assets and supply chains from climate impacts.

WEF President Børge Brende would probably agree: in a January 2024 white paper, he warned that “clearly, the value at risk from inaction highly exceeds the cost of action, with an impact on gross domestic product (GDP), ranging from -8% to 15%”.

In 2022, WEF launched the Resilience Consortium to catalyse public and private-sector efforts, but despite increased awareness, Brende lamented the fact that “private and public sector institutions are still falling short”.

The good news is that investing in climate adaptation pays off for companies, with a benefit-to-cost ratio of up to 53:1 for water collection and storage measures, including rainwater harvesting. A December study by BCG, the Global Resilience Partnership and the United States Agency for International Development (USAID) suggested companies should see climate resilience more as an opportunity than a burden, since most adaptation actions bring positive returns on investment.

Agribusiness is a sector with a lot of resilience “low-hanging fruit”, says Matthews, which is why regenerative agriculture efforts, while tricky to implement at scale, are showing a lot of promise. For example, the report points to the example of PepsiCo, which managed to improve farm yields by 3-18%, cut greenhouse gas emissions by 20% and reduce water use in irrigation by up to 36% on Indian and Thai farms being converted to regenerative practices.

Climate resilience for companies: protecting assets and supply chains

So where should CSOs start the climate resilience journey? The Global Resilience Partnership talks of three opportunities to act: protect, grow and participate.

“First, they need to look at the protection, which is perhaps the more obvious one that has been covered a lot to date. So they need to protect their own supply chains, their own value chains,” Matthews explains.

Physical climate risks can affect businesses in different ways: impacting the availability and quality of raw materials, disrupting operations somewhere along the supply chain, destroying assets in climate-vulnerable regions, putting employees at risk of health conditions, and changing consumer preferences. All of these impacts have financial consequences – the cost of inaction – that companies should strive to measure in order to fund adaptation.

Some of the protective measures deployed by companies include climate analytics, disaster preparedness, and climate insurance, as well as improving infrastructure resilience against floods and extreme weather events.

Another way CSOs can get their companies involved in climate resilience is to help scale up adaptation solutions – the ‘grow’ opportunity. That means investing in or partnering with startups to run pilots around IoT, crop nutrition, water treatment and grid management, for example.

Public-private collaboration and upcoming corporate resilience guidance

Finally, companies can ‘participate’ in public sector implementation of climate resilience measures, by financing public initiatives that have the potential to deliver benefits for companies and investors. For instance, companies including UniSuper, GDF Suez, Samsung, Itochu Group, Macquarie, HSBC and Theiss all provided financing alongside the state government of Victoria, in Australia, to support a water desalination project led by Aquasure, which now supplies up to 150 billion litres of water a year to the greater Melbourne area.

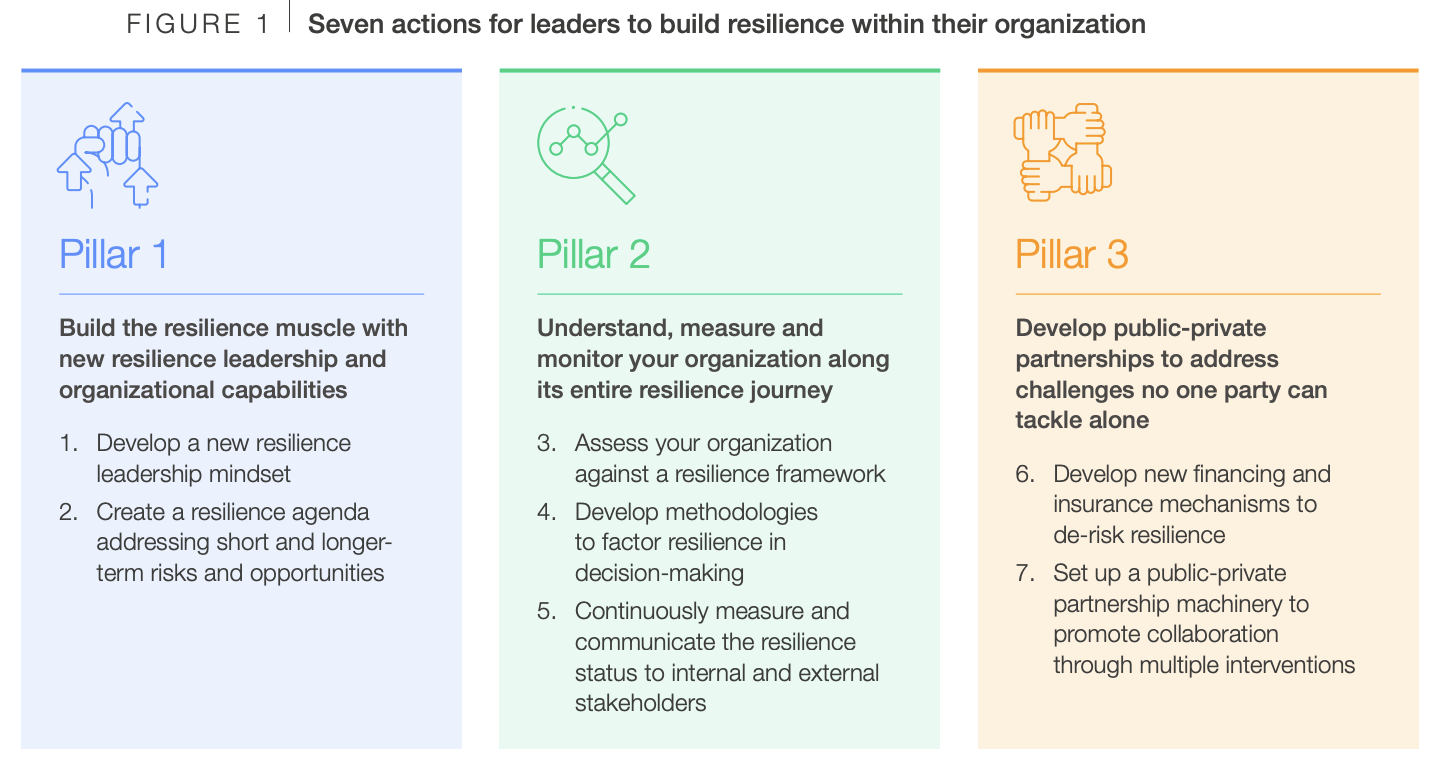

In its white paper, WEF mentions seven actions centred around three pillars, which are roughly aligned with the opportunities described by the Global Resilience Partnership (see below).

Source: WEF

Chief Sustainability Officers may also find guidance in organisations such as Resilience First, which has teamed up with C2ES and Resilience Rising to launch a multi-year initiative to establish a business framework for responding to climate risk, tracking impact, and disclosing action on climate resilience.

“To date, we have consulted with senior representatives of over 40 companies, and engaged NGOs and public sector organisations in virtual and in-person convenings to gather insights from relevant experts and corporate representatives which have helped inform a soon to be launched position paper and the development of the ‘Principles for Corporate Climate Resilience Leadership’,” Quamber-Hill tells CSO Futures.

Climate resilience: From adaptation to transformation

While protecting assets, employees and operations is of course crucial in corporate climate resilience, Matthews believes the most advanced companies and CSOs will be looking to turn climate risks into opportunities.

“Where you might get more opportunity to sell it to a CEO is in the growth space, saying ‘we see the opportunity here for huge growth within [the resilience] sector’. There are a lot of people working on it now, and I think that provides real sway in the boardroom, when you can actually say that there’s a first mover advantage here. And if we’re not in this space in a meaningful way, that will be detrimental to our future business,” he notes.

Turning risks into opportunities is something Zurich’s Head of Sustainability Linda Freiner knows a thing or two about. Zurich has built up a proposition around climate resilience, including data collection and risk analysis, on-site implementation of climate adaptation measures, and completion of sustainability reporting frameworks for its customers. In a recent interview with CSO Futures, Freiner said “supporting our customers in how they manage climate risks” has been a key piece of her work as Head of Sustainability.

In a January CSO Futures panel on sustainability governance, Independent CSO and Non-Executive Director Joanna Bonnett invited other CSOs to “put on [their] blue sky thinking, get around the table with fellow C-suite officers and say, right, if we go through climate change, and this is what our regulation is saying that we’re going to be at risk from, where’s the opposite number of that?”

“Where can those material opportunities be? Sometimes it’s about existing products; sometimes it’s about new products. And it’s a way that the Chief Sustainability Officer can really get to the heart, and dare I say, win the heart of the business,” she added.